CSRD, so what?

From 2024, a new European directive will come into force: the Corporate Sustainability Reporting Directive (CSRD). Initiated by the European Commission in April 2021, this new European regulation on sustainability was officially published in the EU’s Official Journal on December 16th 2022.

It replaces the Non Financial Reporting Directive (NFRD) by requiring more than 50,000 European companies to publish a non-financial report that complies with the standards established at European level (ESRS mentioned below).

A major step forward, this directive aims to make ESG information a major pillar of companies’ economic performance and to combat greenwashing and misleading communication about environmental and social issues.

CSRD / NFDR: what’s changing?

The CSRD replaces and consolidates the NFRD adopted in 2014. The main changes are as follows:

- the scope of application is extended to 50,000 companies (compared with the current 11700)

- introduction of the concept of dual materiality:

- Financial materiality: taking into account the positive and negative impacts of sustainability issues on the company’s financial performance.

- Impact materiality: taking into account the positive and negative impacts of the company on its economic, environmental and social environment.

- the information must be published in reports that comply with the SFDR (Sustainable Finance Disclosure Regulation) and the EU Taxonomy.

- the information will be verified by an auditor or an independent third-party organisation (ITO)

- the publication of the information is compulsory under penalty of public or financial sanctions or a cease and desist order.

Which companies are covered by the CSRD and when do they report?

The European companies concerned meet 2 of the following conditions:

- more than 250 employees

- balance sheet total of more than €20 million

- generating at least €40 million in turnover

This means that SAS and listed SMEs are also eligible.

It should be noted that if the holding company prepares a consolidated report, subsidiaries may be exempt from reporting. However, they will still be required to provide certain information.

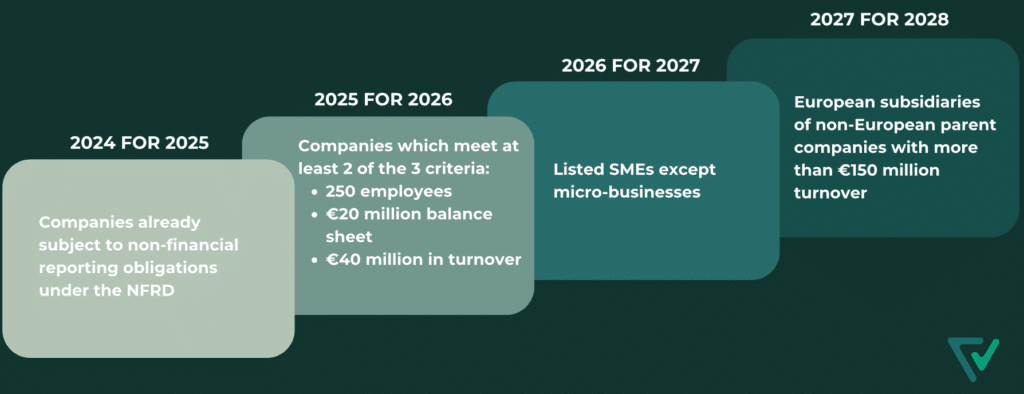

As regards the timetable for implementation, the CSRD provides for gradual implementation up to 2028, depending on the size of the company. Note that the first companies subject to the CSRD must meet the obligations from 1stJanuary 2024, which means that the first official report will be produced in 2025 and will be based on data from 2024:

- 1st January 2024 for companies already subject to non-financial reporting obligations under the NFRD (large listed companies with more than 500 employees).

- 1st January 2025 for large companies not yet subject to the NFRD; and which meet at least 2 of the 3 criteria mentioned above.

- 1st January 2026 for listed SMEs that meet 2 of the 3 following criteria: 10 to 250 employees, turnover of €700k to €40m, or balance sheet value of €350k to €20m (with the option of deferring their reporting obligation for 2 years, and therefore producing a report in 2029 based on 2028 data). It should be noted that companies that do not meet 2 of the 3 criteria are considered to be micro-businesses and are not subject to reporting.

- 1st January 2028 for European subsidiaries of non-European parent companies with more than €150m turnover in Europe. Note that non-listed subsidiaries may be exempt if the parent companies already provide a CSRD-compliant sustainability report.

Below is a summary table:

What reporting method should be adopted? What should you report on?

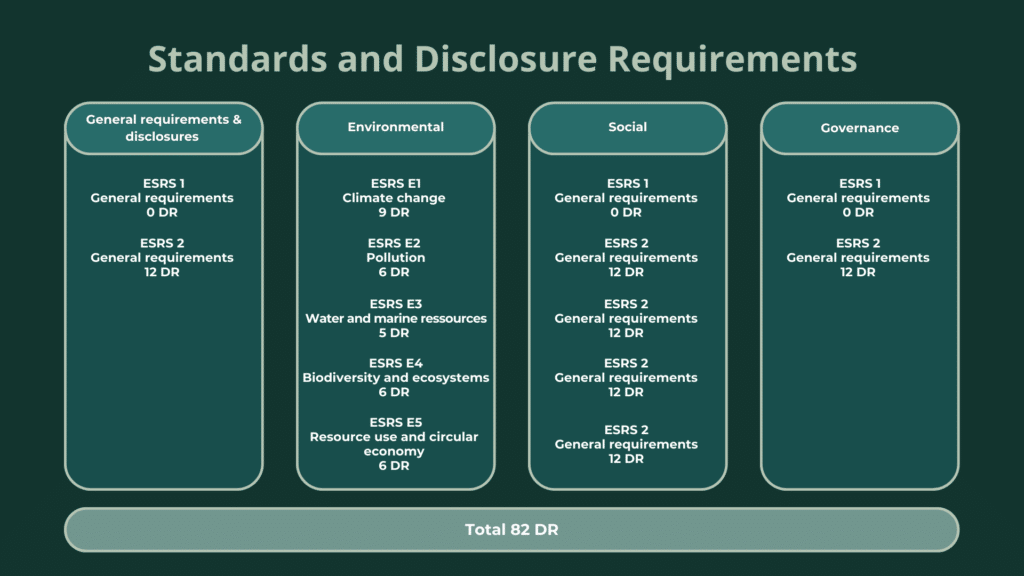

To prepare your sustainability reports, you need to follow the ESRS (European Sustainability Reporting Standards) reporting methodology developed by EFRAG. They aim to harmonise reporting to make it transparent and comparable.

On June 9th 2023, the European Commission published its draft delegated act detailing all the ESRS standards. They cover 4 areas of reporting:

- How governance takes into account sustainability issues.

- How sustainability issues are integrated into strategy and the business model.

- How sustainability impacts, risks and opportunities are identified and managed throughout the value chain.

- How performance is measured (KPIs) and the objectives linked to the action plans and resources implemented.

The ESRS comprise 12 universal standards (2 standards specify the general reporting requirements and the remaining 10 deal with the various ESG criteria) and cover the 3 ESG themes (environmental, social and governance):

After carrying out a dual materiality analysis, the company will have to decide whether to include these criteria (on the DR graph for Disclosure Requirement) in its reporting and justify its choice.

It should be noted that only the criteria (or DR) included in the ESRS 2 “General Requirements” will be mandatory for all companies. These are the cross-sector standards which were the subject of a Delegated Act* on July 31th 2023.

The application of the other criteria (or DRs) varies according to:

- sector of activity: standards specific to certain sectors (currently being defined and Delegated Act scheduled for June 2024 for first application in the 2025 reporting year)

- the type of company: specific standards for listed SMEs (currently being defined and Delegated Act scheduled for June 2024 for first application in the 2026 reporting year)

- the nationality of the company: specific standards for non-European companies (currently being defined and Delegated Act scheduled for June 2024 for first application in the 2028 reporting year)

Verdikt’s guidance:

1 – Anticipate at company level

Although the standards have not all been defined, if you’re part of the 1st circle 2024-2025, we recommend that you proactively anticipate these regulations now or latest January 2024 to have the opportunity to dry run at least once before submitting your final reporting copy. It’s a massive change and several iterations should be necessary.

2 – Pilot at company level

The CSR department will certainly lead the way, ensure overall coordination but engage each company’s stakeholder to contribute respectively to the ESRS related to their activities. As today’s CSR strategy cannot be conceived without integrating its digital component, CIO will surely be asked to actively collaborate and report on their specific performance indicators.

3 – Understand at CIO level

To decrypt what is expected from IT for the CSRD, it’s not unlikely that the CIO call on some experts’ services to save time and focus on the right issues. Verdikt is able to democratize CSRD for IT as well as to formalize and support your journey towards sustainable IT.

4 – Deliver at CIO level

The key point here is to timely collect and process your relevant data and your providers’ ones. Verdikt can do the rest in our platform for your IT organization: sustainability KPIs, maturity indexes, detailed analysis, recommendations for improvement and trajectory simulations, global standards reporting. A continuous improvement process can thus be launched via historical assessments and comparisons over time.

Want to know more about us and our platform.

Book your demo session now.